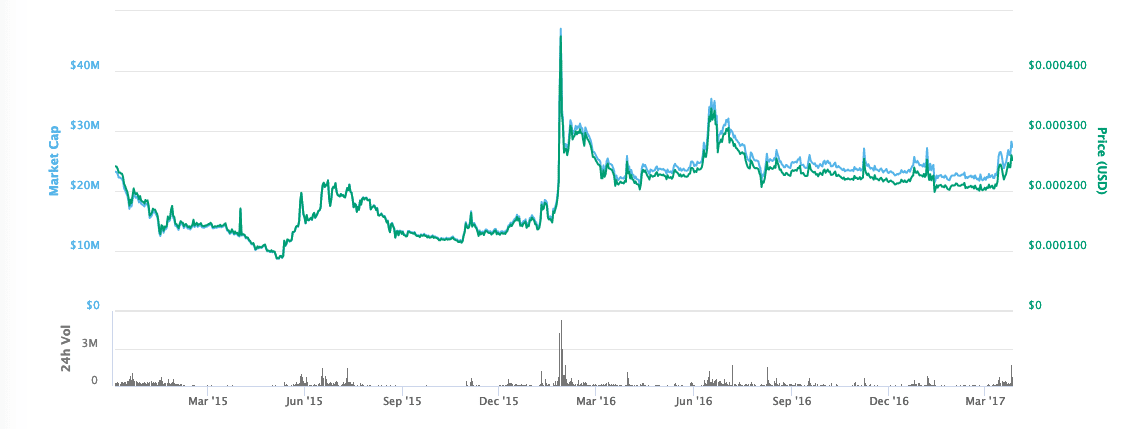

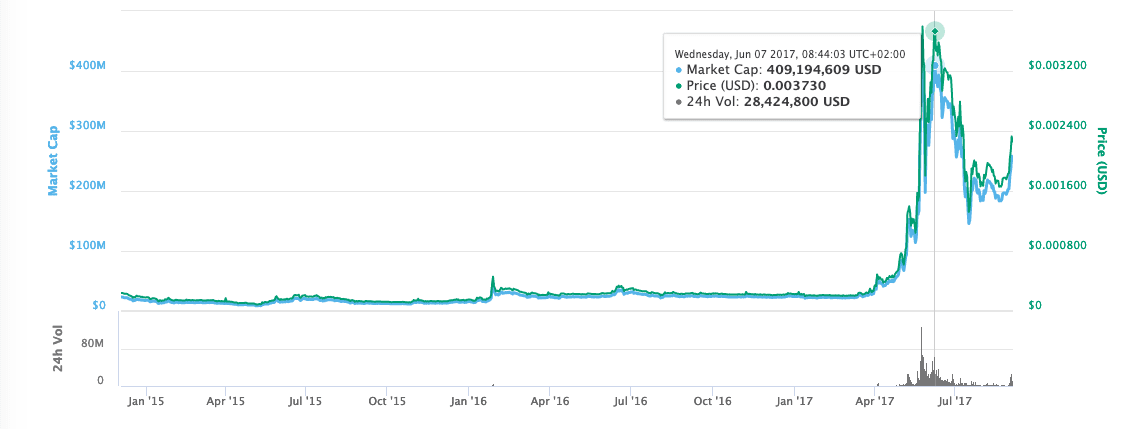

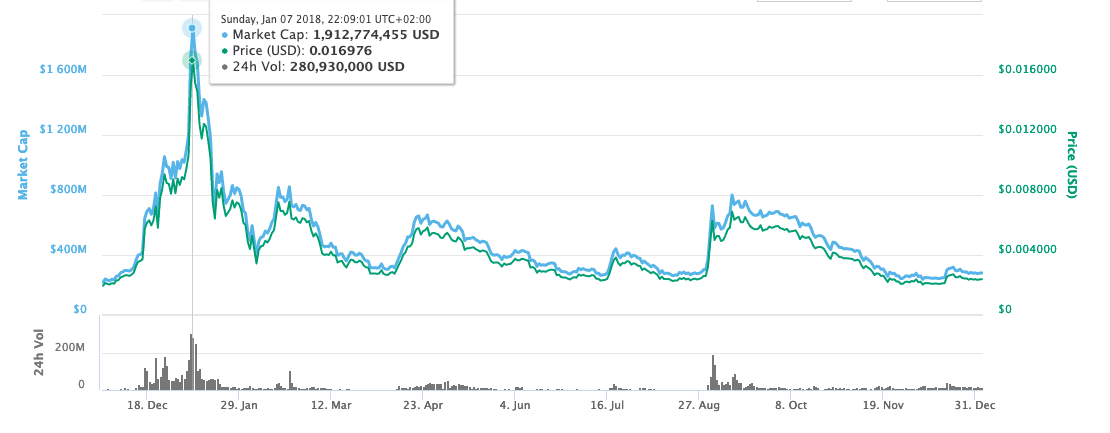

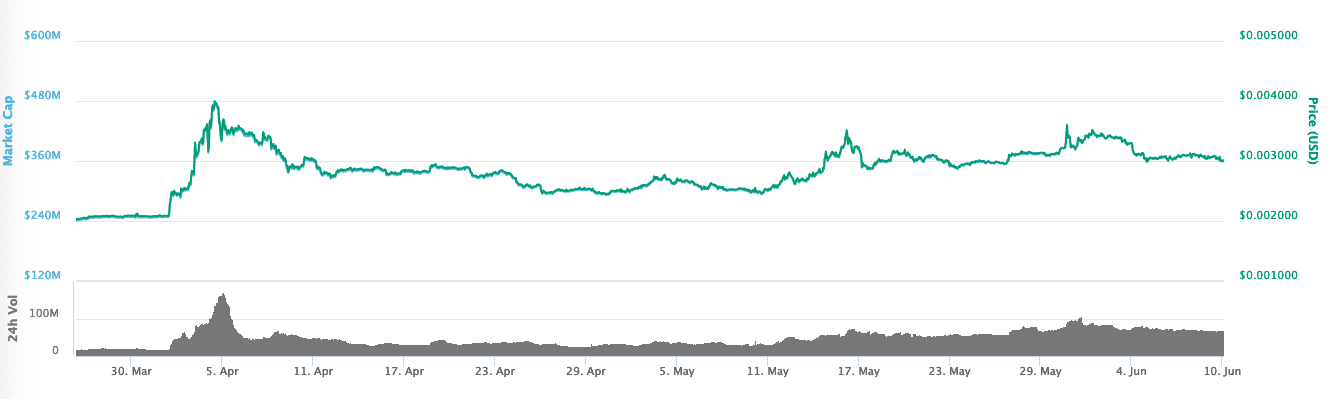

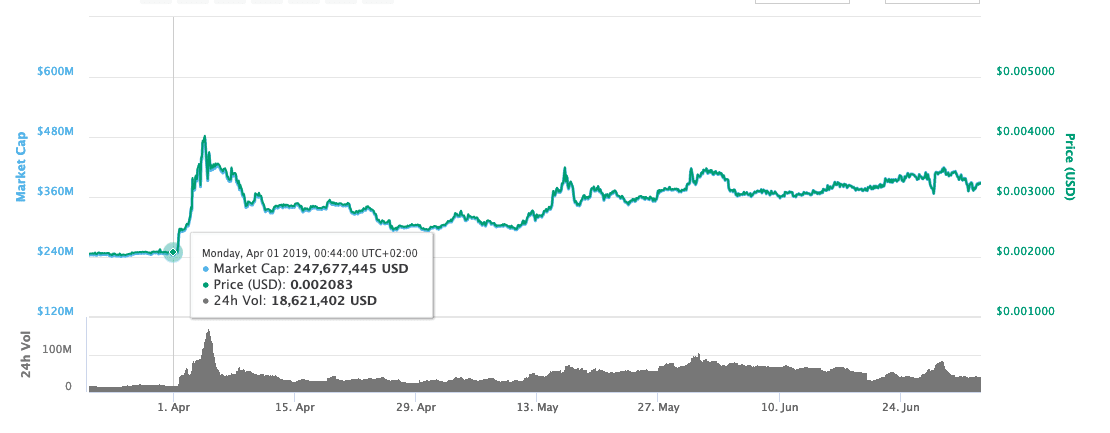

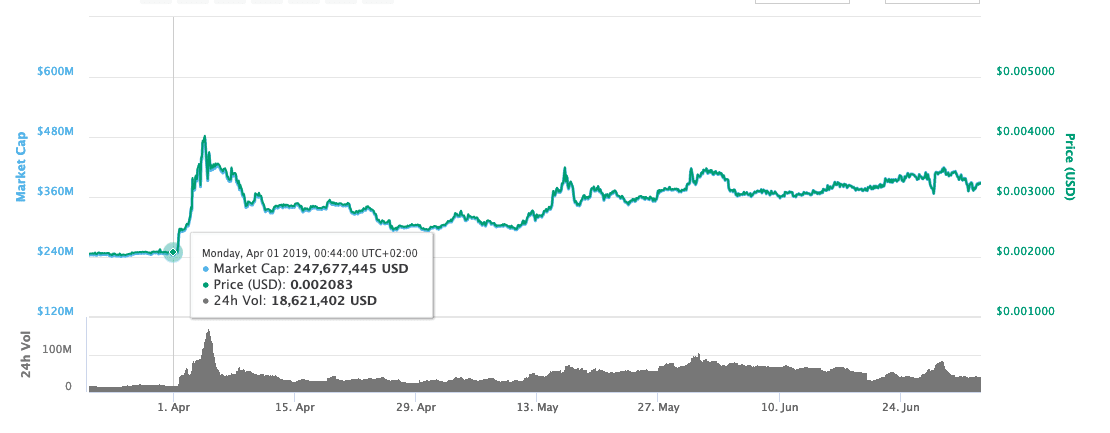

Anyone that’s been involved in cryptocurrency for more than a few months will almost certainly have heard of Dogecoin. And if you’ve ever been on the internet, you’ll probably recognize the Shiba Inu “doge” that acts as the Dogecoin mascot. Sure, Dogecoin might play on the popular internet “doge” meme, but when it comes to cryptocurrency, it’s a serious project. Dogecoin was originally based on LuckyCoin which is essentially a variation of the Litecoin code, which is itself derived from Bitcoin. Dogecoin uses a similar mining algorithm to Litecoin, called Scrypt. As a result, Dogecoin has smaller block times compared to Bitcoin. The Scrypt algorithm also makes it more difficult to use specialist ASIC mining equipment to mine the coins. Though it’s not all fun and games for Dogecoin. Back in 2014, the coin was used to successfully raise $25,000 for the Jamaican bobsleigh team to get them to the Winter Olympics in Sochi. It’s the stuff worthy of a movie deal. One of the main differences between Dogecoin and other cryptocurrencies like Bitcoin, is that it’s inflationary. While there are only 21 million Bitcoins that will ever be mined, Dogecoin has no limit. According to CoinMarketCap, there are over 120 billion Dogecoins in circulation, at the time of writing. Let’s take a look at how those Dogecoins have performed over the last quarter, but first, a quick recap of how it performed in previous years. Dogecoin/USD historic performance recap For two years between July 2015 and March 2017, Dogecoin traded between $0.0001 and $0.0004, with little variation. As with most other cryptocurrencies though, Dogecoin experienced its most notable price increases between mid-2017 to early 2018. At the end of May 2017, Dogecoin’s trading price rose from $0.001066 on May 16 to $0.003747 on May 23, a 251-percent increase. By late September of the same year, the coin’s trading price fell back towards $0.001134. It continued trading around this price until late November when the coin began to grow towards its biggest rally to date. Dogecoin reached its all time high price during the cryptocurrency boom across the winter of 2017 to 2018. On January 7, 2018, Dogecoin was trading at $0.017491, a staggering 1,442% up on where it was trading a couple of months earlier. As was the case with other cryptocurrencies, Dogecoin’s prices fell sharply as 2018 progressed. There were two brief rallies which saw Dogecoin’s price increase noteworthy amounts. The first came in April when Doge’s price jumped from $0.002708 to $0.005868. The second came in late August when Doge’s price jumped from $0.002321 to $0.006575 over a two-week period. Ultimately though, Dogecoin ended 2018 a long way down from the high is saw in early January. On December 20, 2018 the cryptocurrency was trading at just $0.002360, 86-percent down on its lifetime high seen in January. Dogecoin/USD Q2 Dogecoin has shown few signs of ever reaching a trading price like it did during the 2017/2018 boom: since late last year through the first quarter of 2019 it has traded around $0.002. However, at the start of April, Dogecoin’s trading price started heading skyward. It has been on the up, slowly, ever since. On the last day of Q1, Dogecoin was trading at $0.002075; over the next four days its price rose to $0.003854. This upward trend was seen across numerous cryptocurrency markets. Unfortunately, it was swiftly followed by a correction that saw Doge’s price drop to $0.002873. A notable decrease from its early quarter high, but still 38-percent up on where it opened the quarter. Dogecoin had two notable rallies in Q2, the first came in mid-May and saw the cryptocurrency’s price rise from $0.002480 on May 10 to $0.003388 on May 16. However, within 24 hours Doge’s price dropped by 16 percent to $0.002849. The second rally came at the end of May, when the coin’s price rose from $0.002968 to $0.003578. As ever, this rally was followed by a dip which saw Dogecoin’s price drop to $0.003010 on June 6. All these price rises and sudden drops might seem less than stellar for the long term outlook of the coin. However, stepping back and examining Dogecoin’s growth over the entire quarter will be more pleasing to long term holders of the asset. It may have had its ups and downs this quarter, but Dogecoin started April trading around $0.002086 and ended the quarter at $0.003356, a strong 60-percent increase over the three-month period. Major events in Q2 As you might suspect, Dogecoin is never far from the meme culture from which it was born. This is not necessarily a bad thing, it maintains interest in the coin and keeps conversations fun and lighthearted. After all, that’s what its creators set out to do. At the start of April, shortly before the coin’s major rally of the quarter, Tesla’s head honcho Elon Musk said that Dogecoin was his favorite cryptocurrency. He even changed his Twitter bio to read “CEO of Dogecoin,” it was changed shortly after to “retired CEO of Dogecoin.” Even Musk isn’t above the meme. Whatever the case, Musk’s musings certainly seemed to stir some extra interest in the cryptocurrency. In more serious news, Doge was listed on Huobi – one of the world’s top 10 cryptocurrency exchanges by reported volume – in April. According to CoinMarketCap, Huobi is one of the top 20 markets for Doge (at the time of writing). Doge was listed on Huobi on April 4, the day that the coin’s price started retreating from its early quarter high. Seemingly, the anticipation and speculation in the days prior to this listing served as a greater boon to the coin’s price than the actual listing did itself. Rumors were also afloat that another of the world’s largest cryptocurrency exchanges, Binance, would be listing Doge in the near future. In early July, Binance confirmed rumors and listed Dogecoin, according to a support statement. Doge’s price pumped afterwards and had given a good start to Q3 for the cryptocurrency. Looking forward to Q3 for Dogecoin Indeed, Dogecoin getting listed on more exchanges can only be a good thing (assuming those exchanges aren’t ever hacked for Doge). The meme-based cryptocurrency will have a long way to go if it is to maintain the strength it has shown in the most recent quarter. Given that in the months prior to Q2, Doge had shown few signs of life since the famous 2017 bull run. But given Doge’s strong, but perhaps a little volatile, second quarter, the short term prognosis is looking good. Presuming it can maintain the interest that has fueled some of its latest rallies, Dogecoin looks many positive, much hodl, very good.